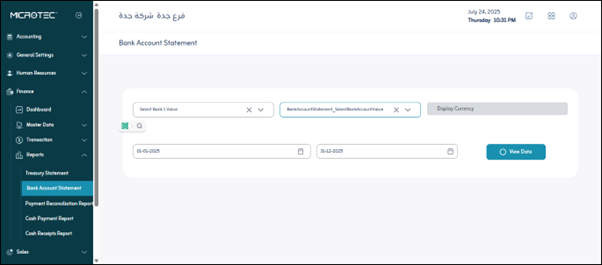

¶ Bank Account Statement

Usage: The screen allows you to view and print all financial transactions made in your bank account over a specific period of time.

¶ Prerequisites for Using the Screen

- The user must have access to the bank statement report.

- At least one bank and one bank account must be defined in the system.

- The relevant financial transactions (payments, daily entries, and fund transfers) must be pre-recorded in the system.

¶ How to Use the Screen

To use the screen, follow these steps:

- Bank Value: From the drop-down menu, select the bank for which you want to view the account statement.

- Bank Account Statement: Ensure this option is selected; it indicates that you are requesting a bank statement.

- Currency: This field will automatically display the currency for the selected bank account, so you do not need to enter it manually.

- Time Period: Select the period for which you want to view account transactions. You can usually choose a start and end date.

- View Data: After entering all the required options, click this button to view the account statement. The data will appear at the bottom of the screen.

- Print: After viewing the data, you can click this button to print the account statement.

¶ Explanation of Fields Appearing After Viewing Data

After clicking “View Data,” you will see the details of the financial transactions in the following table:

- Date: The date the financial transaction occurred.

- Transaction Code: A unique identification number for each financial transaction.

- Transaction Name: A brief description of the transaction type (e.g., deposit, withdrawal, transfer, bill payment).

- Incoming/Outgoing: Indicates whether the transaction represents an amount entering the account (incoming) or leaving it (outgoing).

- Balance: The current balance of the account after each financial transaction.

- Payment Method: The payment method used for the transaction (e.g., cash, check, bank transfer, credit card).

- Source: The party that initiated the transaction or its beneficiary.

- Journal Entry: The journal entry number associated with the transaction in the accounting system (important for accountants).

- Paid By: Indicates the party who made the payment if the transaction is an “outgoing” transaction.

- Related General Account: The general accounting account to which this transaction is linked (e.g., expense account, revenue account).

- Description: A general description of the transaction that outlines its key details.

- Detail Description: A more detailed description of the transaction, which may include additional information not included in the general “Description.”