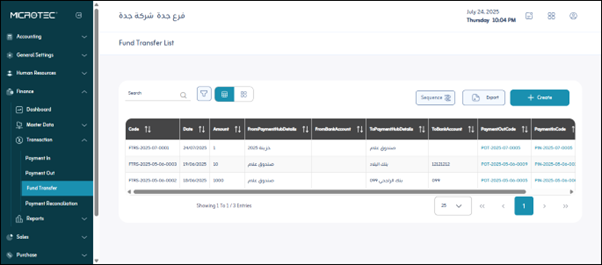

¶ Fund Transfer

Usage: This screen is intended to record and track fund transfers from one cash/bank account to another within the same entity (company or its branches).

¶ Prerequisites

- The user must have the necessary permissions to access this screen.

- The data displayed depends on the transactions available in the system.

When you enter the screen, you are typically in search or view mode, where you can view or filter existing transfers.

- Search: A general field to search for a specific transfer using the transfer code or part of the description.

- Date Search: A field (or two fields, “From Date” and “To Date”) to filter transfers by the date they were made.

- Payment Center: A field to filter transfers by the payment center (which may be associated with the source or recipient account).

- Payment Center Details: A field for more precise filtering based on payment center details.

- Bank Accounts: A field to filter transfers by bank account (source or recipient).

- Status: A field to filter transfers by their status (e.g., approved, pending, canceled).

- View: A button to click after specifying search/filter criteria to view the results.

- Export: A button to export the displayed data (usually to an Excel or PDF file) for external use or archiving.

- Actions (Details - Print): These icons or buttons typically appear next to each record (transfer) in the results list.

- Details: To view all financial transfer details in read-only mode.

- Print: To print the financial transfer document.

- (Note: “Edit” and “Delete” are not directly mentioned; this may mean they are only available prior to approval, through special permissions, or from within the details screen itself.)

- Sequence Button: This button or section relates to the automatic numbering settings for financial transfers.

- Status: Indicates the status of the sequence setting (enabled/disabled).

- Allowed Indicator: May indicate whether this sequence is allowed to be manually modified.

- Sequence Applies To (Company - Branch * - Unit - Screen): Specifies the scope of the sequence. Branch indicates that a branch can be selected.

- Sequence Type (Annual - Monthly - Daily - Continuous): Specifies how the bonds are renumbered.

- Part: This may be a field to add a fixed part to the beginning or end of the sequence.

- Value: The current number of the sequence (i.e., the last number used).

- Option: This may be an additional option to control the behavior of the sequence.

- Actions (Delete): To delete the sequence setting.

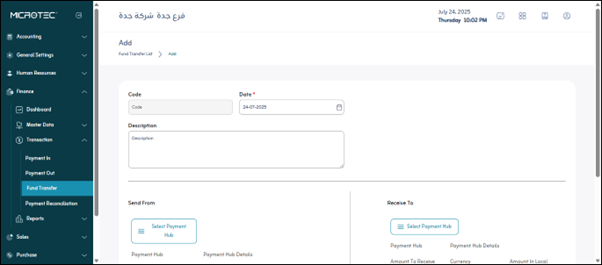

¶ Creating a new transfer (after clicking “Create”)

{.align-center}

When you click the "Create" button (usually a large, clearly marked button), you'll be taken to an interface for entering new money transfer information:

- Code: The money transfer number, which may be manually entered or automatically generated.

- Date*: The date the money transfer was made. Required field.

- Description: A brief description of the transfer (for example, "Transfer from Riyad Bank to Branch A Treasury.").

¶ Send From section (Source Account Information)

This section represents the account from which the funds will be withdrawn.

- Choose Payment Center: Here, you select the cash or bank account from which the transfer will be made (for example, “Main Treasury,” “Riyad Bank Account”).

- Reference: A field for adding an internal reference to the transfer (for example, an internal transaction number).

- Payment Method: The method of transfer (usually “Bank Transfer” or “Cash”).

- Currency: The currency of the source account.

- Send Amount*: The amount to be transferred from the source account. Required field.

- Rate*: If the currency of the source account differs from the currency of the receiving account, or from the system’s base currency, this is the exchange rate used for the transfer. This field is mandatory.

- Local Currency Amount: The equivalent amount of the transfer in the system’s base currency (calculated automatically).

- Current Balance: The current balance of the source account before this transfer.

- New Balance: The expected balance of the source account after deducting the transfer amount (calculated automatically).

¶ Send To Section (Receiving Account Information)

This section represents the account to which the funds will be received.

- Choose Payment Center: Here, select the cash or bank account to which the transfer will be made (for example, “Dammam Branch Treasury”, “Al Rajhi Bank Account”).

- Received Amount: The amount that will be received by the receiving account. In the case of transfers in the same currency, it will be the same as the “Sent Amount”. If there are currency differences or fees, this may vary.

- Currency: The currency of the receiving account.

- Local Currency Amount: The equivalent amount of the transfer in the system’s base currency (calculated automatically based on the exchange rate of that party).

- Current Balance: The current balance of the receiving account before receiving this transfer.

- New Balance: The expected balance of the receiving account after adding the transfer amount (calculated automatically).

- Rate: If the currency of the receiving account differs from the currency of the source account or from the system’s base currency, this is the exchange rate used.

Save: Click to save all entered data and complete the money transfer.